Multiple Financing Products

Multiple Financing Products

Business dynamics are ever evolving and largely impacted by external factors around. Therefore we recognize the need for a business owner to stay ahead of markets and competition and maintain a secure financial standing at various stages of growth and expansion.

From Working Capital requirements to Financing for Buying/Leasing Equipment, from SBA loans to quick Funding to kick off your Start-Up, we stand in solidarity with all our customers to ensure their financial requirements are seamlessly processed at all times.

Our diverse portfolio of lenders and limitless lending options make us a preferred choice for customers seeking cash advances and loans ranging anywhere between a small term advance of 90 days to a long term loan tenure of 5 years.

Get rid of CREDIT HISTORY woes with WOW options from MMN that exercise a holistic review of your finances to bring you realistic products and solutions and help build credibility and sustainability for your business.

MERCHANT CASH ADVANCE

What Is a MCA?

One of the most popular funding option, Merchant Cash Advance or MCA is a lump sum payment offered by funding companies against an agreed upon percentage of future credit card or debit card sales. Unlike the traditional loans, MCAs are characterized by small payment terms.

MCAs are a preferred financing option for most small business entities that are in regular need of liquid funds to sustain and grow their operation. Small businesses often use MCA for expansion, daily expenses etc.

Advantages Of Merchant Cash Advance

- Simple application process

- Less reliance on a perfect credit score

- Quick approvals

- Flexibility in re-payment

- Merchants can utilize the cash advance the way they want

- No collateral or risking of assets required

Eligibility Criteria

- At least 6 months of business standing

- Good credit history

FINANCIALS:-

Amount

The funding amount often varies from one funding company to the other. However the value of MCAs commonly range between 5k to 500k

Term

Mostly short term, however the range may vary from one funding option to the other

Daily Debits

The daily debit amounts are determined by multiple factors.

Documents Required To Apply For a Merchant Cash Advance

- Government-issued photo ID (Drivers License)

- Voided check from your business checking account

- Last three statements from your business bank account

EQUIPMENT FINANCING

What Is Equipment Financing?

This type of financing helps businesses fund the purchase of equipment. There is an array of categories of equipment buying and leasing that businesses can borrow funds for. The amount of the funds approved will vary, depending on the category of the equipment being financed (whether it is new or old). The rate of interest will largely depend on your credit history and your business standing.

The prominent areas where Equipment Financing is more commonly opted for are:-

- Lease or Loan for new or used equipment

- Lease line of credit for equipment capital expenditures

- Transactions for sales-leaseback

- Cash flow loan structures

- Collateral based revolving lines of credit

- Debt financing

TYPE OF EQUIPMENT ELLIGIBLE FOR FINANCING

Manufacturing Equipment –

1. CNC machines

2. Lathes

3. Printing presses

4. Commercial kitchen equipment

5. Welding equipment

Storage & Warehouse Equipment

1. Forklifts

2. Commercial shelving systems

Automotive Service Equipment

1. Automotive lifts,

2. Spray booths

3. Diagnostic machines

Food Services

1. Commercial kitchen equipment

2. Coffee roasters

3. Refrigeration equipment

Transportation Equipment

1. Commercial vehicles

2. Trailers

3. Dispatch equipment

Electronics

1. Computers

2. Displays

3. Printers

4. Communication devices

Advantages Of Financing Equipment

- Working capital remains intact

- Cash flow becomes better owing to a revolving line of credit.

- The equipment can be used as collateral

- Flexible payment structures help mitigate risk for obsolescence of equipment

- Tax benefits can be exercised

BUSINESS LINE OF CREDIT

What Is Business Line Of Credit?

This is a credit line that the business can draw down upon to fund various expenditures. The business only pays interest on the credit that is used, which is similar to the way a typical credit card account operates.

Alternatively, some businesses can obtain a credit line specifically to fund inventory purchases. In this scenario, the most non-perishable inventory is eligible for the funding.

Like a safety net in practice, a line of credit is available whenever your business requires it, but holds no obligation to use it.

Revolving Or Non-Revolving Business Line Of Credit Loan

Revolving – Similar to a credit card, once the withdrawn funds are paid back to the lender, the total line of credit becomes available to borrow from.

Non-Revolving – Unlike the revolving line of credit, in this case, once you have exhausted the limit by borrowing the complete line of credit, you have to re-apply to secure a fresh line of credit.

Advantages Of Business Line Of Credit

- Interest is levied only on the amount of actual funds withdrawn

- No hidden fees

- Ready capital availability

- Credit score doesn’t hamper the ability to secure a loan (however rate of interest may be higher for a borrower with a bad credit score)

- Lower interest rates and closing costs than traditional loans

- Turnaround time is much quicker than other funding options

- Lenders offer multiple payment options ranging from daily to weekly to monthly

- Businesses can draw multiple times from within the set line of credit

Eligibility

There are no pre- set criteria to acquire a Business Line of Credit however

a) Credit score of 600 and above is preferred

b) At least 1-year business standing (some lenders consider 6+ months in business)

c) Revenue of 120k and above (varies with various lenders)

FINANCIALS

Estimated Value Of Business Line Of Credit

Between $10k to $1 million

Loan Term

6 months to 5 years

Interest Rate

7% TO 25%

The interest rate takes into account multiple factors such as the business Credit History, Business Standing, Amount of Line of Credit etc,

Documents Needed

- Driver’s license

- Voided business check

- Bank statements

- Credit score

- Outstanding invoices

TRADITIONAL FACTORING or ACCOUNTS RECIEVABLE

What Is Traditional Factoring?

A traditional factoring agreement is structured so that a merchant or business sells outstanding accounts receivable to a factoring company at a discount in exchange for immediate cash. This product can help ease a period of tight cash flow.

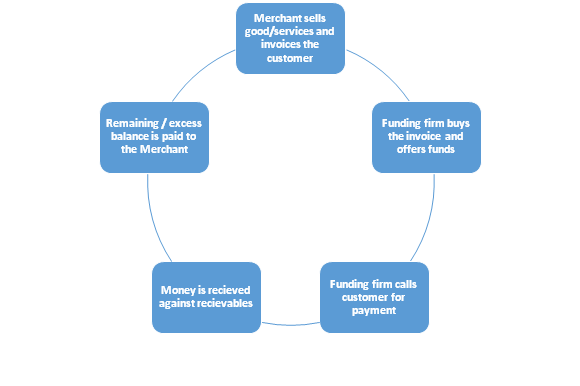

How It Works

Advances are given to merchants against the value of their invoices, which are handled by the funding company. Fees are mostly based on the time of the invoice to be paid off.

Non Recourse Factoring

Non-recourse factoring is the process of adding a bad debt protection, to ensure payments are still received even when the customers are unable to pay invoices.

Advantages Of Factoring

- Allows immediate cash flow

- Collateral free

- Money can be made available for future growth

- In case of multiple better receivables with different credit terms, factoring helps improve the cash control

- The lender manages the accounts receivables, collects payments

Advantages Of Discount/Recourse Factoring

- Flexible, can grow as your business grows, and can reduce when you choose

- Easy to transition back to conventional banking

- Pay off loans, make payroll without worry

- Meet seasonal demands

- Reinvest in business; fund marketing to grow your business

- Receivables management allows you to focus on your core business

- Take advantage of purchase discounts with volume or early payment

Factoring Process Flowchart

Businesses That Find Traditional Factoring Useful?

A) Start Ups

B) Businesses seeking expansion

C) Businesses setting up in new geographies/markets

D) Businesses with payment terms for up to 90 days

E) Businesses unable to secure bank loans or other financing

NOTE: Factoring companies provide as high as 92% funds of the receivable value

Liquor Store Financing

Medical Store Financing

Nightclub finance

Retail Store Financing

Trucking Business Finance